To help you get the most out of your IBC Bank online banking account, follow this demo that will walk you through the process of online banking from start to finish. Remember you can also enjoy a fast convenient way to bank online from your smartphone device with the IBC Bank Mobile App. Online and mobile banking has just about everything you can do in a branch, without the branch. Sign on for 24/7 account access to check balances, pay bills, transfer money, even open new accounts. It's free and easy to use, our security is state-of-the-art and our 24/7 customer service is always available for whatever you need. An excess debit transaction fee may also apply depending on the deposit account used for purchase.

If you purchase foreign cash using your credit card the transaction is treated as a Cash Advance. This means that Cash Advance fees apply and interest is charged from the date of your foreign cash purchase. The foreign exchange rate is final at the time you make the purchase. Depending on the branch you have chosen for pick-up, you can expect it to take anywhere from 3-10 business days to arrive at the bank. In most cases you can expect the cash to arrive in 3 business days.

You want more control of where and when you bank. Our online digital features and mobile banking app make it easier than ever to bank from anywhere. You can check your balances, pay bills, transfer funds, set alerts, and more 24/7 from one place – your laptop, smartphone, or tablet. United Bank does not charge a fee for mobile banking. However, third-party message and data rates may apply.

These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan, and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Bank with United mobile banking app. See the mobile banking terms and conditions in the United Bank Online Banking service agreement. Chase Bank serves nearly half of U.S. households with a broad range of products.

Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more, visit the Banking Education Center. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers.

You can quickly and securely deposit checks with Mobile Deposit using your smartphone or tablet. You'll also have access to your accounts to check balances, access your Fulton Bank Credit Card accounts, track recent transactions, and manage your money. Axis Bank provides easy steps to start online banking. Avail a variety of benefits and services by Axis through the online banking service. Hassle-free internet banking options makes banking with Axis Bank the best. It's a breeze to move money to your savings account, pay down your credit card, loan or credit line, or make a payment on your mortgage2.

You can also transfer money between your RBC Royal Bank Canadian and RBC Bank (U.S.) accounts, instantly and for free3. Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more. Online Banking gives you real-time account information. You can view check images, stop payments on checks, track your debit purchases and set up other tools to manage your money including e-mail balance alerts and online statements. This guide will help you to register and login to online banking for a postal/Doar bank account, so you can make a transfer to your Rewire account to send money home. For a guide on how to start the transfer order with Rewire click here.

Alerts allow you to receive notifications about banking activity and other events on your account. You can set up and manage your alerts on our online banking service at any time. Zelle® is a convenient way to send money using your mobile banking app or online banking account. In addition, purchases made using third-party payment accounts (services such as Venmo® and PayPal®, who also provide P2P payments) may not be eligible for cash back rewards. Apple, the Apple logo and Apple Pay are trademarks of Apple Inc., registered in the US and other countries. Venmo and PayPal are registered trademarks of PayPal, Inc.

In addition, purchases made using third-party payment accounts (services such as Venmo® and PayPal™, who also provide P2P payments) may not be eligible for cash back rewards. Apple, the Apple logo and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries. It's important to us we get our customers banking digitally to support your banking needs.

You can bank securely using Westpac Online and Mobile Banking anytime, anywhere. You can check your account balance, pay bills and transfer funds. A $3.50 cash advance fee/transaction applies and will be charged to your credit card account.

If paying from a Royal Credit Line regular interest charges apply. See your Royal Credit Line Agreement for details. At First West Credit Union, keeping your financial information secure is our top priority. The first time you log in to online banking, you'll be asked to set up some security questions before proceeding with your login. For subsequent logins, you'll only be prompted to answer one of your security questions when the system determines there is a potential risk for online attack.

Our personal online banking makes it easy to manage your money. All you need is a computer with Internet access and a personal access code. Quickly move money between your accounts, send money to others and pay bills, like your credit card. Online applications are available for many of our products and services. And for checking accounts and most credit cards, you'll get an instant decision within 2-3 minutes. We use the latest security technology to ensure your personal and financial information remains private and safe.

Did you know that you can have a notification sent to your smartphone when your account balance falls below a certain amount? With alerts, get relevant, real-time information directly from online banking or our mobile banking app. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. Banking, credit card, automobile loans, mortgage and home equity products are provided by Bank of America, N.A. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Programs, rates, terms and conditions are subject to change without notice.

360 Checking is a checking account that comes with everything you need and without everything you don't. Pay your bills, get cash, make deposits, and transfer money–all without monthly fees and extra trips to the bank. You can open a checking account online and manage your account securely by signing in on your phone or computer, instead of waiting for the bank to open first.

And if you ever need help with your account, a real person is just a phone call away. Alternative access levels are credits only, debits only or full access. Different accounts attached to the additional NAB ID can have different access levels.

Only available to clients with a personal debit card and a personal online banking profile. Once you enroll in online banking, you can download the KeyBank mobile app on to your phone or tablet. You can also sign on to KeyBank online banking directly from key.com. Get secure and easy access to your TBK Bank accounts over the Internet, anywhere you can log in, any time. If you are new to online banking and want to enroll, sign up by clicking the Sign Up Now link. New users can generate a password online by using the 'First time user option'.

You can generate the login password using your debit card 4-digit ATM Pin and your registered mobile number. Enrolling is easy and should only take a few minutes. You'll just need your account number and Security Word. Login to check your accounts, transfer funds, pay bills and more. Easily access all of your United Bank personal accounts 24 hours a day.

Check balances, transfer funds, review transaction history, place stop payments, order checks, and much more—anytime and from anywhere. We will take steps to protect you 24/7, using technology and safeguards that meet or exceed industry standards, but you must also use our online banking services carefully. Staying on top of your credit score doesn't have to be a struggle. There is no cost to use Credit Sense and it does not affect your credit score. Just another way TBK Bank is helping you with your finances.

Choose the checking account that works best for you. See our Chase Total Checking®offer for new customers. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches. Our new homepage features an "overview" of all the information you need in order to manage your account. Your last transactions, your activity in foreign currencies, your credit card payments, your deposits and savings, loans, mortgages etc. Online and from the mobile app, it's easy to send and receive money between almost any U.S.-based bank accounts.

Just enroll with your email or U.S. mobile number and you're ready to go. The easiest way to register for mobile and online banking is by downloading the HSBC UK Mobile Banking app. To continue online, select 'Register for Online Banking'. Interac e-Transfer transactions are free for all personal chequing accounts.

An Interac e-Transfer fee of $1.00 for RBC personal savings accounts, or $1.50 for RBC business deposit accounts, may apply. Maximum transaction limits may apply and are subject to change. Availability of the money will depend on the time when it is sent from RBC Royal Bank or RBC Bank. Transaction may not appear on your RBC Bank (U.S.) account transaction history until the following day but will reflect the date of transfer.

Use Zelle® through online banking - it's a fast, easy, and secure way to send and receive money. Leumi's online services provide a unique banking experience that makes managing your account simple, convenient, safe and secure. Whether using a computer or mobile device, on our website or mobile apps, Leumi customers can obtain up-to-date account information and perform banking transactions. We'll alert you if a new bill payee has been added to your account options in online banking. This is useful to you in tracking fraud on your account since fraudulent activity commonly involves the transfer of funds out of an account to a fraudulent vendor. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Must have a bank account in the U.S. to use Zelle. It's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money. My IBC Bank Online is a smart solution for your personal and business banking needs. Discover the convenience of banking from anywhere, any time.

Manage your finances with the click of a mouse or from your mobile device. Bill Pay is the simplest, most convenient way to pay bills online or with your mobile device. You can schedule payments by due date or receive E-Bills right in Bill Pay and schedule automatic payments. Our easy-to-use Bill Pay service allows you to securely pay your bills online from your Great Southern checking account. If you make a BPAY® payment before 6pm on a business day, we'll send the details to the biller's bank on the same day.

Payments made after 6pm on business days, or at any time on a weekend or public holiday will usually be treated as being received by the biller on the next business day. You'll need to enter your NAB Identification Number, found on the back of your card, and your mobile phone handy to receive a security code. View your account details and transaction history for the last seven years. You can also set up and receive RBC Alerts about your banking activity and available RBC Offers. Pay bills, transfer funds, send money and apply for products—whenever it's convenient for you. We know that banking for college students involves transactions both on campus and at home.

That's why we make it easy to add money to your Independent Bank checking account through Independent Bank offices statewide, by mail or through wire transfers. Consolidation is not the best option for everyone, so do some research before making a decision. Always make sure that you clearly understand the terms of the loan. The federal government allows a six-month grace period from the day you graduate until loan payments must begin. If you choose to consolidate during this time, your grace period will be waived and you will have to start making payments immediately.

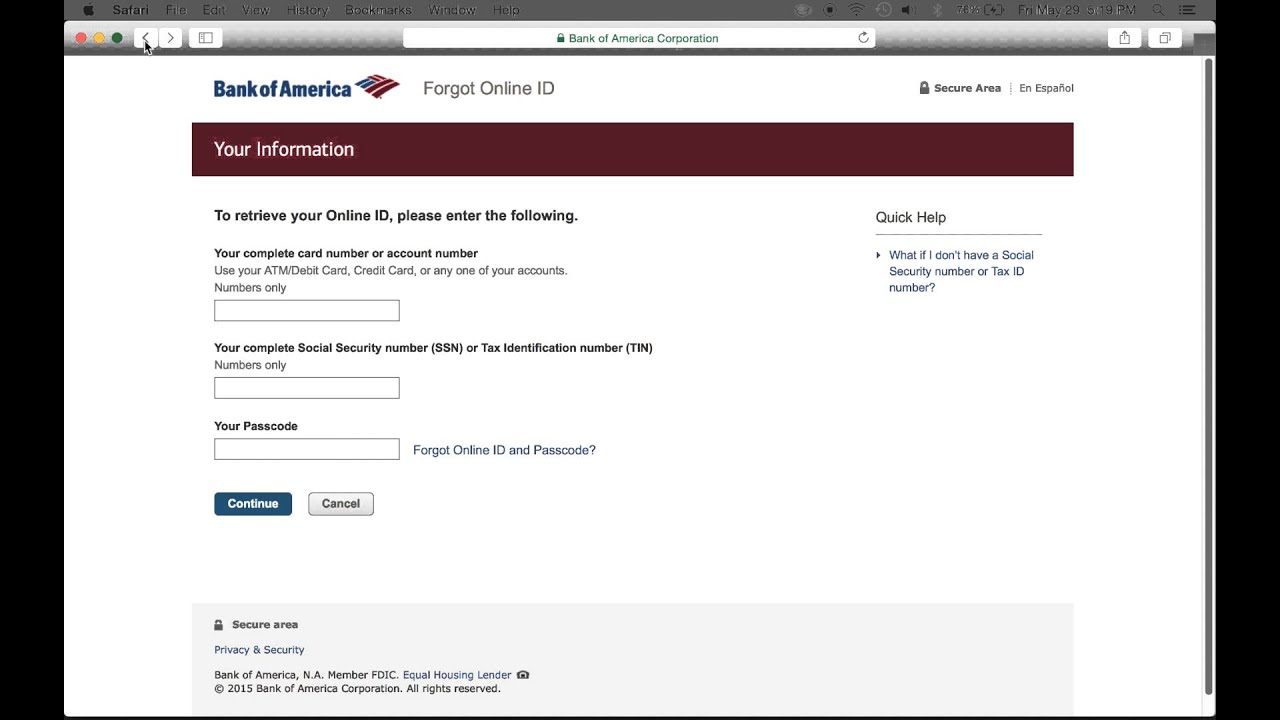

However, some of the lowest rates are offered during this grace period. Once you consolidate, the interest rate is locked in for the life of the loan. Consolidate federal and private loans separately. Unlike private loans, interest on federal loans may be tax deductible, and you might be able to defer payments if you go back to school. That's why we recently changed our authentication procedures. We now only allow account authentication through a phone call or text message, which is required if you're signing into your Online Banking from a new device or location.

Money Manager is provided to help you manage your personal finances and is not intended to provide legal, tax or financial advice. Mobile Banking services may be affected by phone signal and functionality. Pay bills, send money, transfer funds between your accounts — whenever it's convenient for you. A new online banking tool to turn your spending habits into savings. Every time you use your Member Card, you can "top up" your purchase to add to your savings account. Retailer Offers is a free service that lets you earn up to 15% cashback from a variety of major Retailers.

Once you switch on Retailer Offers in Online or Mobile Banking, you'll be able to choose the offers you want and earn cashback when using your Santander debit or credit cards. Quickly and easily transfer money between accounts, pay bills within less than two days with Bill Payor set-up recurring payments. U by BB&T® is our mobile and online banking experience with enhanced features to help you manage your financial life. Over 6 million of our customers already bank online. It only takes a few minutes to register for Online Banking. Start enjoying a service that provides a quick and secure way to manage your finances 24/7.

Want to know when your paycheck hits your account or your credit card payment is due? It's easy with our customizable email or text alerts. Go paperless to avoid paper statement fees as well as the hassle of storing physical documents; plus you can view up to two years of your deposit and credit card statements. Bidding paper statements goodbye is one more step towards a cleaner environment.